Thanks to the internet, social media and mobile technologies, buyer’s are more self-directed than ever before, using these tools to conduct independent research that informs important purchasing decisions for themselves and the companies they work for.

However when it comes to B2B buyers, specifically those looking to purchase tools and software from technology vendors, while independent research is a major trend, 60% say their vendor is an influential part of the purchasing process, according to TrustRadius’ new report, The B2B Buying Disconnect.

Of course, that’s not the whole story. While technology vendors—namely their marketing and sales teams—play an undeniably important role in the purchasing process, they may be missing the mark or leaving opportunities on the table by focusing on the wrong things. And that’s precisely what TrustRadius’ study aimed to uncover.

Billed as a landmark study, TrustRadius surveyed more than 600 technology buyers and vendors with the goal of identifying key areas of alignment and disconnect, and unearth opportunities for vendors to increase their influence in the purchasing process.

“Buyers are looking for a balanced, relevant and realistic view of products,” TrustRadius CEO Vinay Bhagat said in a report press release. “When vendors proactively connect buyers with content providing that view, they can increase their influence in the purchasing process.”

Below we dive into some more interesting insights from the report, and the opportunities that go along with them, so you can increase influence and build more trust with your buyers.

#1 – Buyers want hands-on experience with the product before committing.

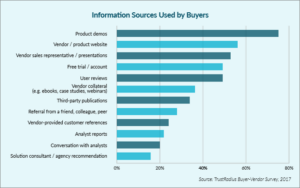

According to the report, product demos are the most helpful resource for buyers and free trials are the most trustworthy sources of information.

“Buyers recognize that direct experience with a product is the best way to evaluate it,” the report stated. “Note that in qualitative responses, buyers especially liked demos that were personalized for their situation or use case. Conversely, they questioned the value of demos that felt biased, rehearsed, or too general.”

The opportunity: Take steps to customize and personalize the demo and trial experience. This will give buyers the experience and information they need to determine if your product is the best fit for their needs.

#2 – Existing customers are an untapped resource.

According to the report, nearly half of the buyers surveyed were product promoters, giving a product they’re using a 9 or 10 on the satisfaction scale, and 91% planning to renew. In addition, 42% have independently recommended the product directly to a peer or colleague. However, of those who recommended the product, just 30% provided an official reference, testimonial or case study for the vendor.

The opportunity: Leverage your existing base of happy customers by encouraging their participation in testimonials and case studies, as well as being a reference contact for other prospects. These content resources may take more effort and time to create, but they’ll be more useful and effective.

In addition, use customer feedback to inform your product strategy and improvements, as well as identify new prospects, and retention and upsell opportunities.

#3 – Buyers find “marketing collateral” unhelpful.

Vendors share a lot of content, referred to as marketing collateral in the report, but the type of content they’re sharing is often missing the mark with buyers.

According to the report: “More than half of vendors produce and share each of the following types of marketing collateral: blogs (85%), white papers (83%), videos (78%), infographics (63%), and ebooks (56%). Aside from videos, they are also the least challenging to produce or provide. Yet vendors identified these five content types as the least effective at convincing prospects.”

Unsurprisingly, for buyers, marketing collateral was one of the least trustworthy and helpful information resources, specifically noting that this content seemed like it was aimed at converting them into leads rather than providing helpful information.

The opportunity: Stop creating fluffy, easy content and strive to create content that allows you to be the best answer for your buyers. Be real, be honest and be transparent, and provide a range of different resources that paint a realistic view of your product.

#4 – Third-party validation can be ultra powerful.

After product demos and vendor-provided customer evidence, third-party resources such as analyst reviews and user reviews are the next most effective content types, according to the report.

“This disconnect stands out as a missed opportunity for vendors, since buyers find third-party validation fairly helpful and trustworthy. In particular, third-party reviews are unique in that they are the only form of customer evidence not controlled by the vendor. Buyers said they were more helpful as well as more trustworthy than vendor-provided references, and vendors themselves said they were slightly easier to provide than customer references.”

The opportunity: Encourage your customers to review your product and service on reputable third-party review sites. In addition, consider reaching out to relevant, leading industry publications or thought leaders, and ask them to demo and review your product. If you’re confident in your products capabilities and benefits, as well as aware of its limitations, the insights shared in third-party reviews will better inform your prospects, showcase what you offer and give you an opportunity to improve your product offerings.

#5 – Strategic vendors have more influence.

Most buyers described vendors as a necessary and practical resource, rather than a strategic partner. But for those who vendors that do play a strategic role, 89% of buyers said they were somewhat or very influential in their purchasing decision.

According to the report: “Buyers who described a strategic role mentioned activities such as on-site visits, extended trials, demos with real data, customization options, and demonstrating ROI. They also highlighted help with convincing stakeholders and positive “non-salesy” interactions with vendor representatives.”

The opportunity: Show your true value by aligning your key internal stakeholders, and sales and marketing departments, and designing a nurture strategy that provides a personalized customer experience across digital, print and people-facing channels.

Want More Insights?

What steps are you taking to better understand your B2B buyer’s journey, and the content that is the most relevant and useful to them? Tell us in the comments section below.